The All Weather Portfolio is the right place to be, even in a rising interest rate environment. A durable, well tested and satisfying strategy.

Bridgewater Associates, lead by the messianic Ray Dalio, is the world biggest hedge fund group with $150bn under management.

Bridgewater’s All Weather Portfolio, which adopts a risk parity approach, was founded in 1996 (although the firm itself dates further back to 1975).

Despite claims that Dalio pioneered risk parity, the CTAs had been using a similar approach for years. Commodity Trading Advisors equalize their position size in terms of risk so that typically a position in short term bonds would be a great deal larger in $ terms than a position in a more volatile asset such as gold. The public came to know the method as fixed fractional position sizing and for many years it was primarily associated with the trend followers such as Bill Dunn, JW Henry and the Turtles.

According to Wikipedia:

The risk parity approach asserts that when asset allocations are adjusted (leveraged or deleveraged) to the same risk level, the risk parity portfolio can achieve a higher Sharpe ratio and can be more resistant to market downturns than the traditional portfolio.

Roughly speaking …….each asset (or asset class, such as bonds, stocks, real estate, etc.) contributes equally to the portfolio’s overall volatility.

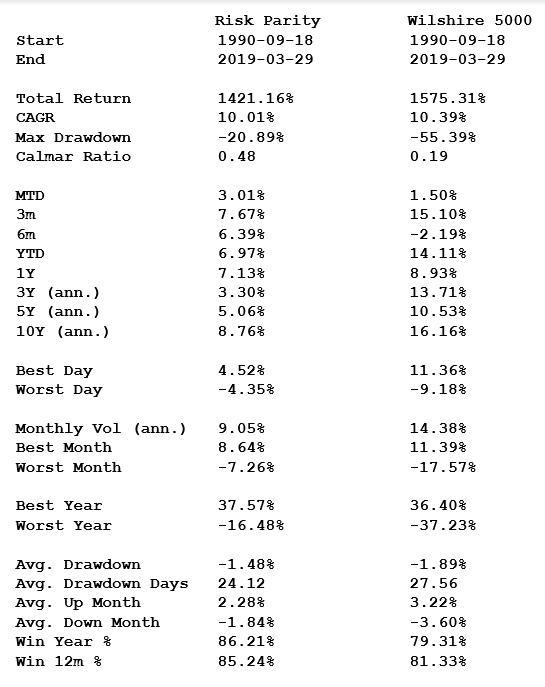

Since 1989 by way of example the Wilshire 5000 Total Return Index has recorded a compound annual growth rate of 10.36%, for a maximum peak to valley drawdown of 55% and monthly annualized volatility of 14.46%.

Over the same period, the US Five Year Treasury Note, accessed via the futures markets, has achieved a CAGR of 2.72% for a maximum drawdown of 9.78% and monthly volatility (annualized) of a mere 3.95%. The exact return depends on rollover dates and averaging strategies over different futures.

A simple version of the risk parity portfolio would be to leverage lower risk bonds using the futures market for a better risk adjusted return than a traditional 60/40 stock/bond allocation.

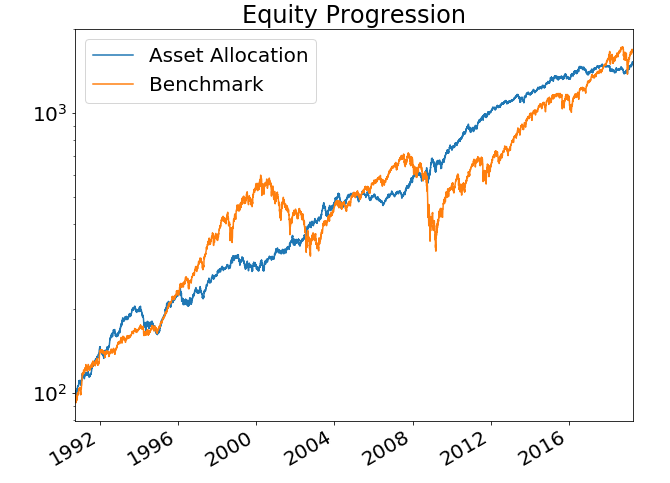

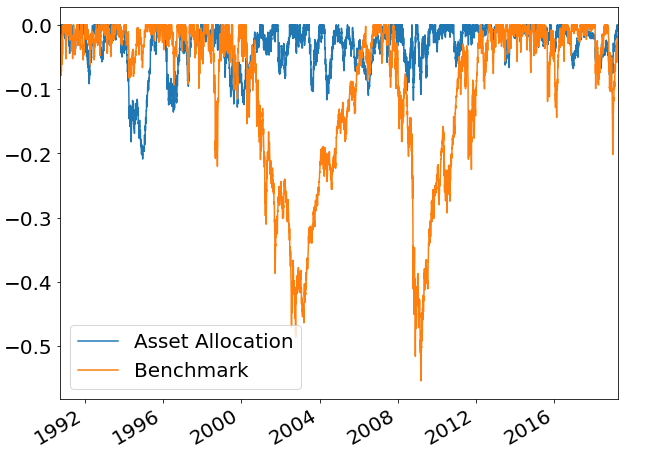

The charts and data below show one variety of such a scheme. In back testing, such a scheme produces an equivalent return to the stock market for far less risk. Maximum drawdown is less than half that of the stock market and volatility is only 2/3 that of pure stock investment.

Many “Talking Heads” have been wondering over the past few years whether the All Weather Portfolio’s magic spell will be broken as interest rates rise. Will a leveraged position in bonds become a dangerous powder keg?

Well that depends just how leveraged you are and in what maturities. An un-leveraged position in US Long Bond futures in the early 1980’s would have recorded a peak to valley drawdown of a massive 39%. So woe-betide an investor with three times leverage if we get another Paul Volcker and a huge and rapid rise in interest rates in a little over 6 months.

An un-leveraged position in the US Five Year Treasury in the early 80’s would have fared much better: maximum drawdown of 15% and manageable volatility Even with some modest leverage, the investment would still have been attractive, especially combined with stocks (providing the correlation or rather non-correlation remains at reasonable levels).

People also tend to forget that rising interest rates are actually good for bond returns – providing the rise in rates is not too sudden and happens over an extended period, any capital loss will be more than offset by higher coupons. At least in nominal terms (un-adjusted for inflation).

People tend to forget (or perhaps they never realized) that over 90% of the return on bonds is from coupon, not price.

My conclusion is that the All Weather Portfolio is indeed All Weather” and should ride through the next few years unfettered by rising interest rates or even a temporarily declining stock market.

This simple exercise has shown the durability of the method and indeed its ability to provide superior risk adjusted returns over extended periods of time and through different (and difficult!) stock market and interest rate cycles.

Do not be too hasty to write it off.

Hi Anthony,

Don’t imagine you ever saw this article I wrote, but the basic idea is to let the hedge fund managers and CTAs implement a risk parity approach for you. CTAs are nicely uncorrelated to other hedge funds. Hedge Fund managers are much better at risk control than stock indices, so you get smaller drawdowns and positive skew. Bonds provide some stability (though with rising rates I am still not sure how you navigate duration risk).

https://www.raynergobran.com/2017/11/the-case-for-hedge-funds-and-managed-futures/

I am planning on writing a couple more articles on Markowitz and its drawbacks, finishing on what I think is the best all-around portfolio construction approach.

Best, Ian

LikeLiked by 1 person

Thanks Ian, most interesting. Yes, I have done a lot of work in Python on the classic mean variance optimization approach and eventually veered off into something much simpler.

I also very much like and agree with your “indexed” approach. Where there is an investable index which is well maintained and has comprehensible on good common sense methodology then for my money that is the way to go.

Of course if you want to leverage it that is a different matter. Easy enough with futures but I suppose institutions use cheap money from prime brokers.

LikeLike